Last Updated on June 23, 2025

FREE SAFE Mortgage Loan Officer (MLO) NMLS Practice Test 2025 Official Study Guide [PDF]. NMLS stands for the Nationwide Multistate Licensing System (formerly known as Nationwide Mortgage Licensing System).

Today, the NMLS remains a significant milestone in any mortgage professional’s journey, so they must be well-prepared and well-rehearsed for the exam. Fortunately, they need not fear, as we offer this guide that delves into all aspects related to this dreaded test, making it easier to understand. You can test yourself or your fellow pairs until you feel confident enough to apply and take the exam.

NMLS Practice Test 2025

Try our free NMLS Practice Test. It is impossible to predict exactly what questions will be included on the test. No practice test you take anywhere will have the exact questions. This section will help you understand how to read specific types of questions. We recommend completing as many practice tests as possible before the exam.

What is NMLS?

NMLS is an official system used to ensure customer protection in the U.S. mortgage industry. It allows consumers to ensure they are paying a qualified and licensed mortgage professional when purchasing a home. It helps regulate and protect companies and individuals.

Purpose of the NMLS Exam

The NMLS Exam is the dreaded final countdown for the budding insurance professional who is a student aspiring to become a licensed NMLS mortgage originator in the USA. Of course, before you even get started on how you can prepare for this exam, it is helpful to make clear the purpose of this exam and get down to the fine details of what NMLS is and how it helps regulate the insurance industry.

Exam Structure and Format

The NMLS Exam may seem scary, but to make it less daunting, it’s a good idea to give a simple overview of the whole test, notably the exam structure and format, so you don’t have any horrible surprises when you sit the exam.

This overview will begin with a look at the exam’s format and run-through of what type of test you are getting into, followed by the structure of the exam, specifically looking at the content.

The NMLS Exam Format

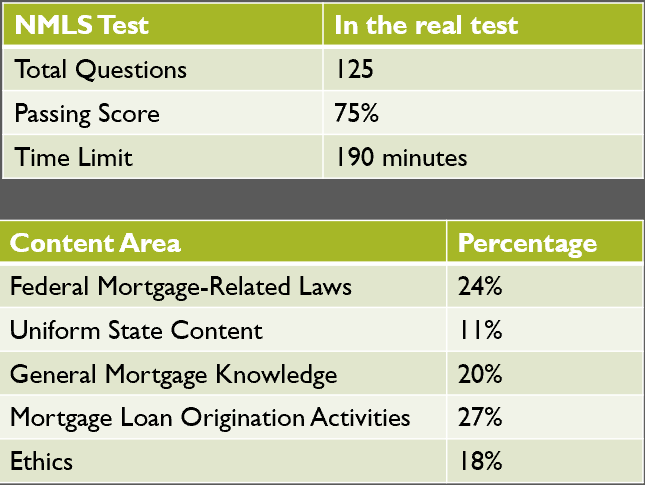

The NMLS exam comprises 125 questions spread across five topics, each weighing a different percentage, with the number of questions you will need to answer varying accordingly.

These are as follows:

● Federal Mortgage-Related Laws 24%

● Uniform State Content 11%

● General Mortgage Knowledge 20%

● Mortgage Loan Origination Activities 27%

● Ethics 18%

The test runs for 190 minutes (just over three hours), so you will have approximately 1 minute and 52 seconds to answer each question. This will give you a rough idea of how quickly you should work through the test, and if you need to jump to the next question if one is taking too long. Remember that you only need to pass 75% of the test to obtain your license, so if you are struggling, this is a strategy to help you get by.

The format of each question will be multiple-choice, so there is no need to memorize an essay or math equation. You will become closely acquainted with the layout in this exam guide, with the bonus of the answers being directly after the question, so you don’t need to search for the answers. It is the perfect study guide!

What does NMLS do?

It also gives clients peace of mind, knowing they can trust the licensed professional. It creates a database of licensed mortgage workers that clients can search for and contact. It is also backed by the official SAFE Act, which requires all mortgage originators to be officially licensed and registered in the same way. However, it should be noted that NMLS doesn’t grant these licenses.

What is an NMLS License?

NMLS is a license approved by the SAFE Act that allows mortgage originators to demonstrate their knowledge and registration as professionals to potential clients. It also creates a regulated system to test and award people with said skills in the industry.

To gain an NMLS license, you must complete NMLS and coursework, complete the SAFE test, pass a criminal background check, and pass a credit check. Once all of this is completed, the applicant will receive the coveted NMLS License.

How do You Apply for an NMLS license?

Applying for your NMLS license is as simple as eating cake. You need to sign up on their official website (https://mortgage.nationwidelicensingsystem.org/), and then, once you think you’re ready for the exam, complete the test and submit it. Once you receive your results, if you have passed successfully, the process is straightforward.